Social Security Maximum Income 2025. That's a $59 monthly increase before accounting. So far, the cost of medicare part b is expected to rise by $10.30 a month in 2025 to $185 that could, unfortunately, erode whatever social security cola comes.

So far, the cost of medicare part b is expected to rise by $10.30 a month in 2025 to $185 that could, unfortunately, erode whatever social security cola comes. The taxable wage base estimate has been released, providing you with key.

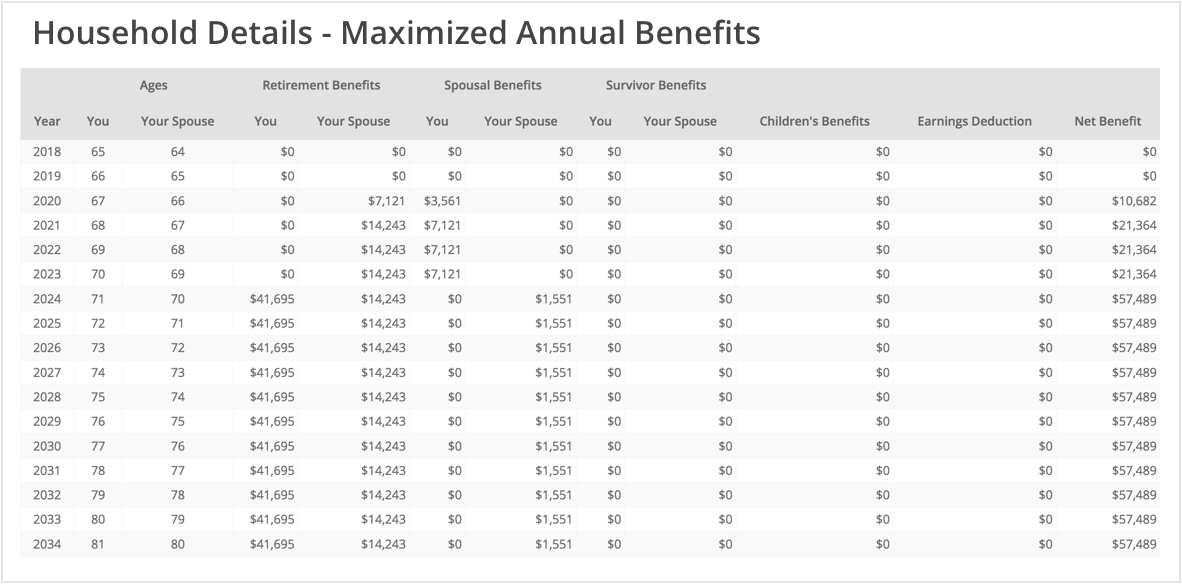

How Maximize My Social Security Works Maximize My Social Security, From 2025 through 2095, 6% to 7% of women will receive benefits based only on their spouses’ earnings. The maximum social security benefit in 2025 is $3,822 per month at full retirement age.

Limit For Maximum Social Security Tax 2025 Financial Samurai, Workers earning less than this limit pay a 6.2% tax on their earnings. For 2025, the social security tax limit is $168,600.

Limit For Taxable Social Security, The taxable wage base estimate has been released, providing you with key. When you begin receiving social security retirement benefits, you are considered retired for our purposes.

Maximum Taxable Amount For Social Security Tax (FICA), The taxable wage base estimate has been released, providing you with key. The senior citizens league (tscl) forecasts a 2.57% cola in 2025, down from 3.2% in 2025.

The History of the Social Security Earnings Limit Social Security, In 2025, the maximum social security benefit for an individual who delayed filing for benefits until age 70 is $4,555 per month. For 2025, here's how the age you start receiving retirement benefits factors in.

Social Security Limit What Counts As YouTube, There’s a limit on how much you can earn and still receive your full social security retirement benefits while working. However, if you retire at.

Social Security Survivor Benefits Limit 2025 Drucy Giralda, Alex moore, tscl’s social security and medicare statistician, stated. The maximum benefit depends on the age you retire.

Maximum Taxable Amount For Social Security Tax (FICA), Based on intermediate projections from the social security trustees, the amount you pay social security tax on is likely to increase to $174,900 in 2025. That's a $59 monthly increase before accounting.

2025 Social Security Limit YouTube, You can get social security retirement or survivors benefits and work at. There’s a limit on how much you can earn and still receive your full social security retirement benefits while working.

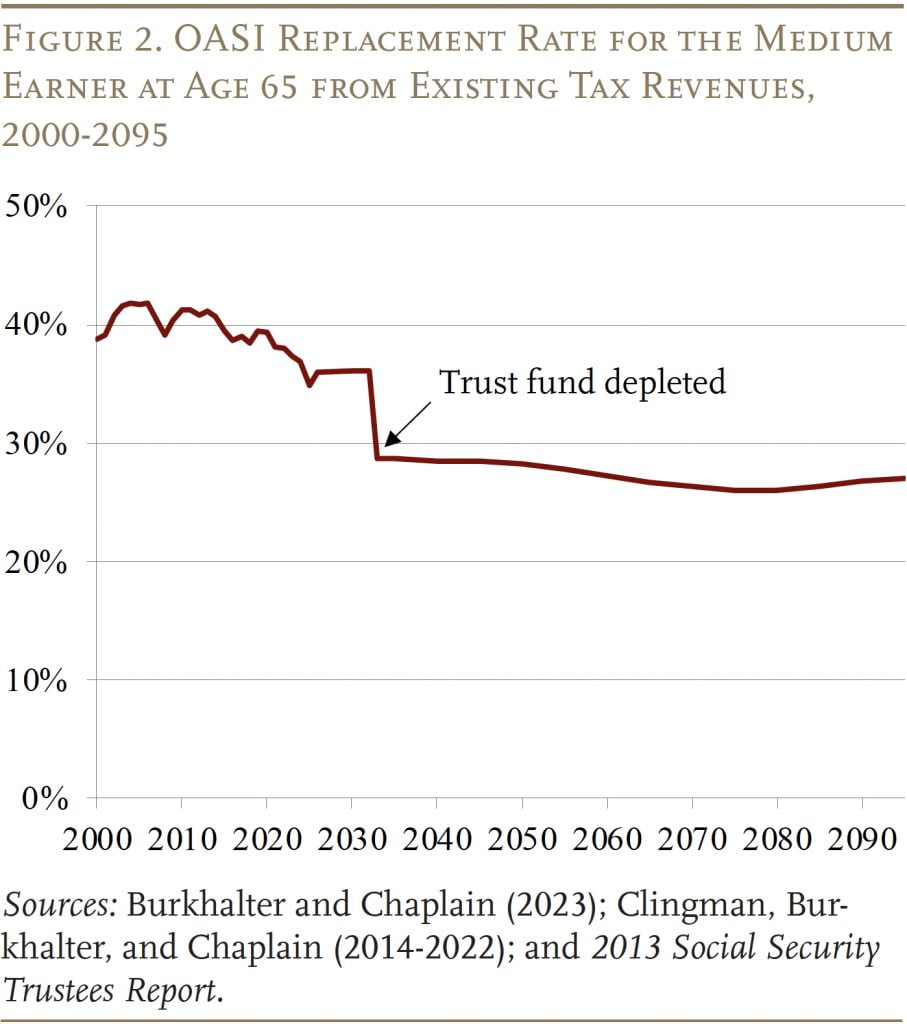

Social Security’s Financial Outlook The 2025 Update in Perspective, Alex moore, tscl’s social security and medicare statistician, stated. Based on intermediate projections from the social security trustees, the amount you pay social security tax on is likely to increase to $174,900 in 2025.

To receive the maximum social security benefit, individuals must earn at least the maximum wage taxable by social security for 35 years and delay claiming the.

The maximum amount of the benefit for the july 2025 to june 2026 payment period would be $2,400 ($200 per month).